Survey of Job Stress and Mental Health Status of Finance and Office Workers

1. Introduction

<A Study on the on the Work-related Mental Illness of the Finance workers> was conducted for the mental illness among finance workers such as securities, loans, saving & deposit, and insurance from March to November 2020. The aim of this study was to understand the state of mental illness in the entire financial industry in various perspectives using article analysis, questionnaires, and interviews.

The article analysis identified the distribution and trend of suicides of financial workers (109 cases) which appeared in the media over the past 30 years. The analysis of the survey data described the patterns of mental illness for 1,181 union members and specified the differences among groups. Interviews with 16 members were to reveal how the distribution of mental illness is related to organizational structural factors.

2. Article Analysis: Trends

The overall trend of the suicide of finance workers showed a steep increase (22 cases in the 1990s, 32 cases in the 2000s, and 55 cases in the 2010s). In particular, the period of 2010-2013 (6 cases, 7 cases, 7 cases, 14 cases) and 2004-2005 (10 cases, 6 cases) was particularly high. Large-scale downsizing, such as consolidation of branches or reduction of manpower, was likely to play a major role.

Work-related suicide accounted for 40.9% (9 of 22) of the total suicide in the 1990s. Most were bank workers. In the 2000s, 37.5% (12 of 32) were work-related suicides and the majority were by securities workers. In 2010, work-related suicides accounted for 47.3% (26 of 55) of suicides. Work-related suicide cases have shown an increasing trend, and the reported work-related factors were associated with pressure on performance. This trend was particularly evident in the 2000s and in the suicide cases of securities workers.

Most of the news articles on the suicide case of financial workers particularly paid attention to the workers’ illegal practices. The incidents like borrowed-name accounts and selling to friends and families occurred when the boundaries between business practices and illegal acts were blurred under performance pressure. It seems that filling the performance with illegal acts has been quite frequent in the industry.

This is not to say that illegal practices are not problematic. When illegal practices are represented in articles, the “context” in which suicide has been induced by the performance-squeezing system is omitted in many cases. As these illegal acts are focused in media, suicide appears to be only a personal problem, and the performance-squeezing system is likely to be repeated again. Therefore we should thoroughly problematize the performance-oriented organizational culture and management method which makes a context that induces suicides of the workers.

3. Survey analysis: the situation

The mental health indicators of finance workers were ‘red flags’. The rate of high-risk drinking and emotional exhaustion after work was very high. More than 50% of participants were classified as a job stress high-risk group in all industries. More than 90% of workers responded that emotional labor was not supported by the organizational protection system and the rate of workers experiencing emotional dissonance reached 80%. In addition, most of them were exposed to sexual or mental violence in the workplace, and 90.4% of the participants have experienced workplace bullying at least once when 25 examples were used as criteria of workplace bullying.

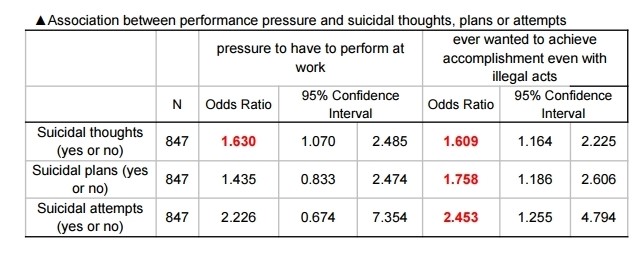

Second, ‘performance pressure’ was identified as typical risk factor for finance workers. “Pressure on sales and work performance” was the most frequent factor in increasing labor intensity, and more than 80% of the workers responded ‘yes’ to the item, “I feel pressure to have to perform at work,” and 26.4% answered ‘yes’ to the question of ‘have you ever wanted to achieve accomplishment even by conducting illegal acts?’ In addition, performance pressure was highly associated with suicide ideation, plans and attempts.

While the overall mental health indicators were red flags, the level of risk varied by industry and job. First, loans and saving & deposit showed the highest burden of performance pressure among the industries. In the insurance workers, in terms of emotional labor, the rate of feeling the lack of the support system in the workplace was the highest, and feeling emotional dissonance was prevalent the most. Security workers felt the pressure to achieve performance even by doing illegal work most commonly.

Second, by job, women in ‘head office management and support’ had the highest rate of depression. The job that required the most mental exhaustion was ‘Branch site management and support’. The workers with this job also received the highest stress from relationship conflict and job instability, and anxiety, depression, and suicidal thoughts/plans/attempts among men showed the highest rate. 95% of the workers in ‘head office sales’ were experiencing performance pressure. In addition, a lot of them were exposed to physical violence from customers as well as mental and sexual violence in the workplace. All of them answered that they were not supported in the workplace regarding emotional labor. On the other hand, women in ‘head office sales’ had the highest rate of suicidal thoughts. In the case of ‘sales and compensation at branches’, 95% of the respondents answered that they felt pressure to perform, and 43.7% answered that they want to achieve results even by doing illegal acts. They felt emotional dissonance the most regarding emotional labor, and women in this job experienced anxiety and suicide attempts highly. ‘Call Center’ workers showed the highest score with 14.2 points of the Borg scale, which estimates the degree of difficulty in work, and 90.3% of the respondents also complained of mental exhaustion. Their job instability and job demand were the worst evaluated items in the job stress survey. They experienced mental and sexual violence from customers the highest rate (93.1%). Lastly, in ‘Computational IT’, 70% of respondents responded that they experienced sexual and mental violence in the workplace, and women in this job experienced suicidal thoughts the highest rate (50%) compared to other jobs.

4. Interview Analysis: Meaning

The first keyword is ‘performance pressure’. The biggest factor for stress of finance workers was performance pressure. The mental illness of workers found 20 years after the introduction of the performance-based pay system in the early 2000s can be seen as evidence of the fact that workers are internalizing ‘self-exploitation’ for performance. For the securities industry, the suicide of workers can be viewed as an event that occurs in the structure where individual workers bear the “risk” of the securities industry itself. Under the severe anxiety for the high risk and the 24-hour global financial system, securities workers often suffer from long working hours and insomnia. For the insurance industry, many workers complained of panic disorder because of consumers’ “absurd complaints” that were received by the Financial Supervisory Service without any reasonable reason. On the other hand, the performance pressure system has lasted only with the changed title of the “underperforming program”. Also, it was quite friendly with the male-centered organizational culture that forced women to give up or be determined excessively.

The second keyword is ‘price to be cursed’. Insurance compensation workers were living with apologetics, securities workers were to compensate for customer losses at their own expense, and branch managers and support workers had to take a low stance, such as having to apologize so as not to make a noise at the branch. Their kindness and apology were closely related to performance pressure. Despite the enforcement of the ‘Emotional Workers Protection Act’, many workplaces have lacked protection because they have not attached much importance to this matter.

The third keyword is ‘structure raising monsters’. It would be appropriate to view bullying of the boss as a result related to the system of performance pressure, not the individual’s personal characteristics.Organizational ‘reasonable’ methods such as excessive assignment of work to a specific person, exclusion from promotions, and making false performance records to make one person’s high achievement were being expressed as violence called workplace bullying.

Fourth, technological change. Branch managers and support workers complained of extreme labor intensity due to branch reduction and consolidation. They emphasize that there is still too much work for ‘people’ to do behind the new technology change. Even those who did not immediately relate to the change in the working environment were engulfed in anxiety. We found that there was a lot of stress on the development of ‘new finance’ products.

Finally, response and support. There was a strong tendency to cope with job stress by individual strategies such as hobbies rather than organizational responses or support. Also, due to concerns about stigma, the workers avoided getting treatment for mental illness. Regarding the EAP (Employee Assistance Program) program, the workers pointed out that it was not well-known to the workers, it was difficult to access the program, and the workers had concerns about being known to the company. The EAP program is the “minimum” support that the company can provide for workers with mental health complaints, not the maximum.

5. How to improve the situation

First, it is needed to establish a workers’ mental health promotion system for each company. Although mental health problems were generally severe, most of the participants had dealt with it individually. It is necessary to prepare a system for finding the cause of mental health problems, providing necessary resources, and helping members with mental illness adapt. In order to establish such a system, the recognition that mental illness is an organizational problem should be preceded. On the other hand, there are various causes of mental problems by industry, job, and gender, which require follow-up measures such as investigations, focus group discussion, and education for union members. The introduction of a ‘workplace-based mental health institution’ modeled after the ‘Healing Center’ of the Seoul Transportation Corporation may also be effective. Lastly, there is an urgent need to prepare a comprehensive system and prevent programs for high-risk groups (those who attempted suicide, 3.6% of male and 5.5% of female).

Second, it is needed to seek alternative models other than performance-driven financial labor. As indicated by the high correlation between performance pressure and suicidal thoughts, plans, and attempts, it was once again confirmed that the performance pressure was a key stressor. Performance evaluation and distribution principles need to be improved. This will be possible through the preparation of fair performance evaluation standards to the workers, the setting up an evaluation committee, and an open discussion on evaluation methods for each workplace. There is also a need to improve organizational sales practices. Instead of developing high-risk products or aggressive sales methods, stable operation methods can reduce job stress of the workers. A worker’s participation in the evaluation of product development or sales practices is also needed.

Lastly, training for union officials should be given priority for the establishment of the union’s strategy and policy. This education should develop empathy and sensitivity for mental health. In addition, the legal system needs to be improved in order to raise the “average” state of the entire industry. The National Federation of Office Finance Trade Unions should bring about a change in the legal system that can sooth financial workers’ “common pain”. For example,‘work suspension and evacuation’ or ‘risk assessment’ which are listed under the Occupational Safety and Health Act could be introduced in the <Capital Market and Financial Investment Business Act> with suitable adjustment for the financial industry.

Comments